Dr. Thota Chandrashekhar I.A.S (Rtd) M.Sc, Ph.D

Biography

Press Releases

12 Sep 2023

బి ఆర్ ఎస్ ఎపి చీఫ్ డాక్టర్ తోట టీడీపీ, వైసిపి పార్టీలతో విసిగి వేసారిన ఆంధ్ర ప్రజానీకానికి బి ఆర్ ఎస్ పార్టీ ప్రత్యామ్నాయంగా మారిందని ఆ పార్టీ ఆంధ్రప్రదేశ్ రాష్ట్ర అధ్యక్షుడు డాక్టర్ తోట చంద్రశేఖర్ పేర్కొన్నారు. అవినీతిలో ఈ రెండు పార్టీలు పోటీపడి రాష్ట్రాన్ని అప్పుల ఊబిలోకి నెట్టేశాయని ఆరోపించారు......

Read more

16 August 2023

ఎపి ప్రజలు తెలంగాణ మోడల్ ను కాంక్షిస్తున్నారని బిఆర్ఎస్ ఎపి చీఫ్ డాక్టర్ తోట చంద్రశేఖర్ వ్యాఖ్యానించారు. రాష్ట్ర విభజనానంతరం తెలంగాణా తో పోల్చుకుంటే ఆంధ్రప్రదేశ్ అన్ని రంగాల్లో పూర్తిగా వెనుకబడిందని ఆందోళన వ్యక్తం చేశారు. పాలకుల నిర్లక్ష్యం వల్ల ఎపి లో వనరులున్నా అభివృద్ధి సున్నా అని విమర్శించారు....... .

Read more

6 June 2023

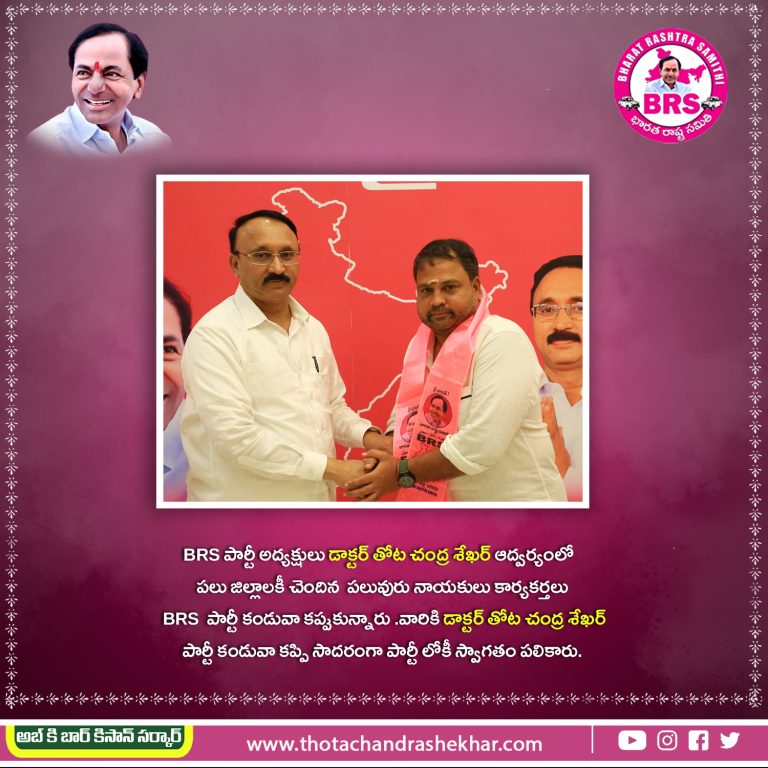

ఎపిలో వైసీపీ ప్రభుత్వ దురాగతాలను ప్రజల్లో ఎండగతామని భారత రాష్ట్ర సమితి ఆంధ్రప్రదేశ్ అధ్యక్షులు డాక్టర్ తోట చంద్రశేఖర్ విమర్శించారు. సోమవారం హైదారాబాద్లోని బిఆర్ఎస్ ఎపి క్యాంప్ కార్యాలయంలో జరిగిన కార్యక్రమంలో ఆయన మాట్లాడుతూ ప్రజా సంక్షేమానికి పెద్దపీట వేస్తామని అధికారంలో వచ్చిన వైకాపా సర్కార్ పాలనలో అన్నిరంగాలు నిర్వీర్యమయ్యాయని..... .

Read moreVideos

JOIN THE JOURNEY

BRS

Social Networks

Latest Updates

Social Networks

Website Visitors

Candidates

political & activism WordPress theme.

Proecessitatibus mei an, choro mediocritatem no vis. Vide congue nonumy nec id, dicat feugait mei no. Brute corrumpit contentiones sit ex, usu no clita iudico civibus. No has delenit perfect lorem ipsum dolor.

Elections start for…

Our dedicated team

Read more about our latest events, campaign and activity.

Proecessitatibus mei an, choro mediocritatem no vis. Vide congue nonumy nec id, dicat feugait mei no.

John Doe

Vide congue nonumy nec id, dicat feugait mei no. Brute corrumpit contentiones sit

Jane Doe

Suas iracundia his ea errem ridens nam an veniam lorem ipsum dolor sit amet.